Conventional fixed rate mortgage calculator

Conventional loans can come with a fixed or adjustable rate and they can be conforming meaning they fall within the loan limits set by the Federal Housing Finance Agency FHFA or non. Some mortgage programs such as the conventional.

5 Year Fixed Mortgage Rates And Loan Programs

A 30-year fixed-rate home loan is a mortgage that will be completely paid off in 30 years if all the payments are made as scheduled.

. Filters enable you to change the loan amount duration or loan type. Use this mortgage calculator to estimate your monthly payment for various properties. The lowest fixed rate.

Average rates for a 30-year fixed-rate mortgage surged as high as 581 in late June but have since leveled off at 555 as of August 25 according to Freddie Mac. Unlike a 30-year fixed rate mortgage adjustable rate mortgages ARMs come with a fluctuating interest rate that rises or lowers along with market conditions. Refinance to a fixed-rate mortgage.

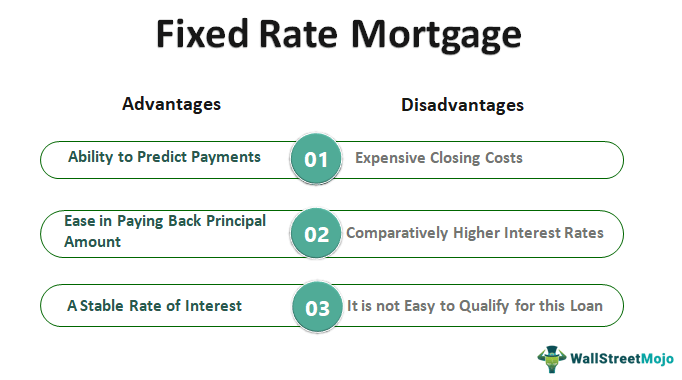

Conventional rate-and-term refinance. They are also available in adjustable-rate options. Your monthly payment stays the same for the entire loan term.

Mortgage Rate APR Change. With a fixed-rate loan the interest rate remains the same for the entire span of the mortgage. Predicting 5-year Fixed Rates.

The lowest 5-year fixed bank discretionary rate was 244 also in 2016. Minimum monthly payments on these loans depend on external factors and opting for. Conventional 30 year fixed.

Conventional loans are commonly offered in 15 and 30-year fixed rate loans. Fixed-rate mortgage interest rate and annual percentage rate APR For graduated-payment or stepped-rate mortgages use the ARM columns. Refinancing from a 30-fixed FHA loan to a 15-year fixed-rate conventional loan eliminates MIP and helps slash interest charges.

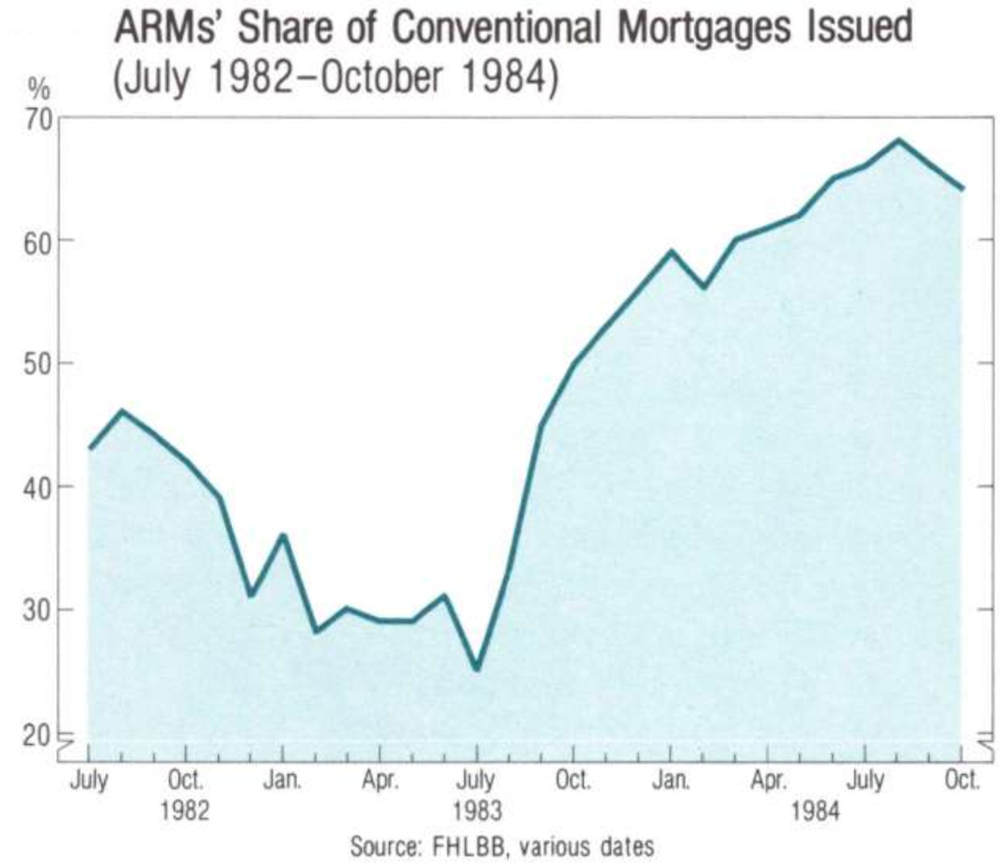

By 1984 ARMs accounted for about 60 of new conventional mortgages closed that year exclusive of FHA VA loans. We offer a wide range of loan options beyond the scope of this calculator which is designed to provide results for the most popular loan scenarios. Lock-in Redmonds Low 30-Year Mortgage Rates Today.

The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgages. When talking about a 30-year fixed-rate mortgage it typically refers to conventional loans. The all-time record low for a non-teaser 5-year fixed rate was 191 in November 2016.

Resources and tools. Mortgage points or discount points are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. Conventional 15 year fixed.

Conventional mortgages may offer a lower interest rate and Annual Percentage Rate APR than other types of fixed-rate loans. 30-year fixed-rate mortgage lower your monthly payment. How much money could you save.

With a fixed-rate mortgage or a conventional loan the interest rate wont change for the life of your loan protecting you from the possibility of rising interest rates. Calculator Rates 7YR Adjustable Rate Mortgage Calculator. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today.

Its impossible to accurately forecast rates long term. This was a default insured cash-back effective rate offered by a mortgage broker. Conventional 30 year fixed.

Conventional 15 year fixed. 5431 5493 006. This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI.

By default 250000 30-yr fixed-rate loans are displayed in the table below. One mortgage point is equal to about 1 of your total loan amount so on a. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time.

A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. Depending on your financial situation one term may be better for you than the other. But borrowers can also take 10-year 20-year and 25-year terms.

More flexible qualification guidelines than conventional loans. No interest rate surprises. Thats still nearly double.

You can generate a similar printable table using the above calculator by clicking on the Inline. You should adjust the default values of the mortgage calculator including mortgage rate and length of loan to reflect your current situation. 6006 6037 003.

To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability.

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

Fixed Rate Vs Adjustable Rate Mortgages

Downloadable Free Mortgage Calculator Tool

Fixed Vs Arm Mortgage Calculator Mls Mortgage Arm Mortgage Amortization Schedule Mortgage Amortization Calculator

:max_bytes(150000):strip_icc()/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Interest Only Arm Calculator Estimate 2 1 3 1 5 1 7 1 10 1 Io Monthly Mortgage Payments

Mortgage Calculator How Much Monthly Payments Will Cost

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Conventional Mortgage Calculator What Is A Conventional Home Loan Prequalify Calculate Your Monthly Payments Today

/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

Fixed Rate Vs Adjustable Rate Mortgages

Downloadable Free Mortgage Calculator Tool

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Fixed Rate Mortgage Definition Type Example Vs Variable Rate

Fixed Vs Arm Mortgage Loans Mortgage Mortgage Loan Originator Mortgage Infographic

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

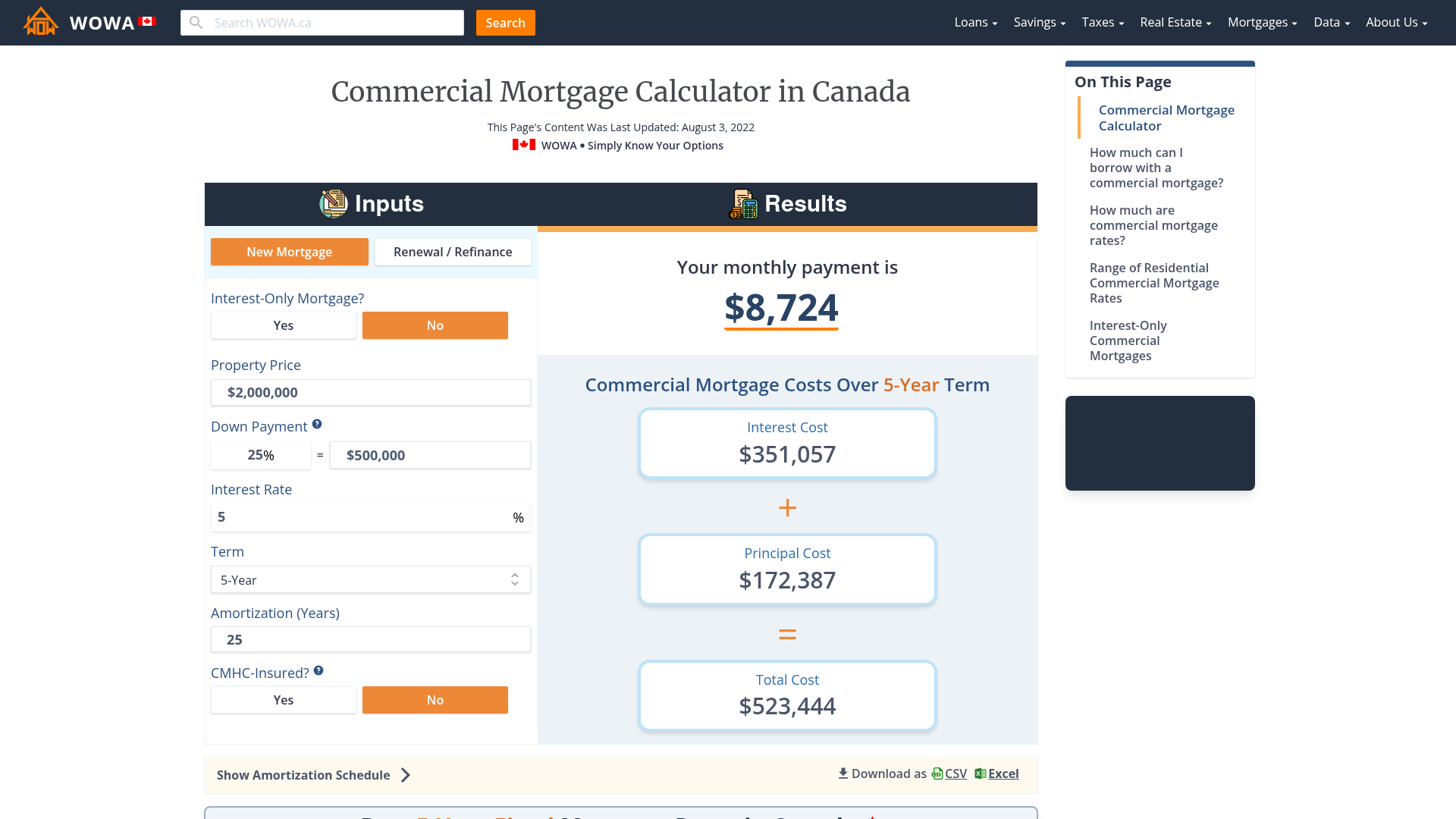

Commercial Mortgage Calculator Payment Amortization

Mortgage Calculator Money